ESG is Making its Way Into Global CRE Ratings and Valuations

A 2021 global investor intentions survey revealed that 60% of respondents had integrated ESG criteria into their investment strategy.

New standards are beginning to emerge in several industries, especially in the global commercial real estate and the property sector. According to 2023 study by PWC, 40% of global energy use and carbon emissions come from buildings alone, and can make a strong environmental impact if remedied effectively.

The Lay of the Land

In the West, President Biden and the United States Council on Environmental Quality has mandated a 50% building emission reduction target by 2032 and a net-zero emission target by 2045. Similarly, Australian government officials look to formulate aggressive ESG legislation in early 2023 to catch up with, or surpass, other global territories.

These types of global mandates and acceptance in the private sector are magnifying the importance of ESG in commercial real estate investing- but what does that look like in practice?

Can ESG Deliver Returns?

A vital question surrounding ESG investing in Australia and around the world, is whether it can generate the same or enhanced returns for developers and CRE lenders as non-ESG investments. At this time, there is a growing body of evidence that ESG investing may generate a “green premium,” and enhances asset values and rents.

Conversely, buildings with low environmental performance will be seen as less desirable and as a result less valuable and will lease or sell at “brown discounts”.

Many analysts forecast that “green” buildings will depreciate slower than non-green buildings. Building upgrades, LEED certification, and carbon efficient facilities will likely meet long-term government mandates and can contribute to a property being highly rated (explained further in this article).

Australian property assets with high ESG performance are a strong differentiator for the long-term. According to LoanConnector, green and sustainability-linked loan (SLL) volumes reached nearly $13 billion in 2021, up from $6 billion in 2019.

In fact, many superfunds such as AustralianSuper have committed to following the United Nations’ Principles for Responsible Investment (PRI), the first of which states that companies should “incorporate ESG issues into investment analysis and decision-making processes.”

ESG Reporting and Ratings are Still in Development

ESG’s importance is spreading through the private and public sectors, but, has yet to be fully incorporated into credit ratings, making analysis and investment strategies somewhat challenging.

Credit agency risk factors tend to evaluate the impact of ESG components on a transaction’s underlying revenues, expenses, cash flow, and valuation. However, new benchmarks are being developed to assess sustainability factors.

Global Real Estate Sustainability Benchmark (GRESB)

The Global Real Estate Sustainability Benchmark (GRESB) provides independent ESG performance data and benchmarks for real estate and other financial markets. GRESB is where many of the largest publicly traded firms report their environmental performance, and covers more than 2,200 real estate and infrastructure entities accounting for $6 trillion in AUM.

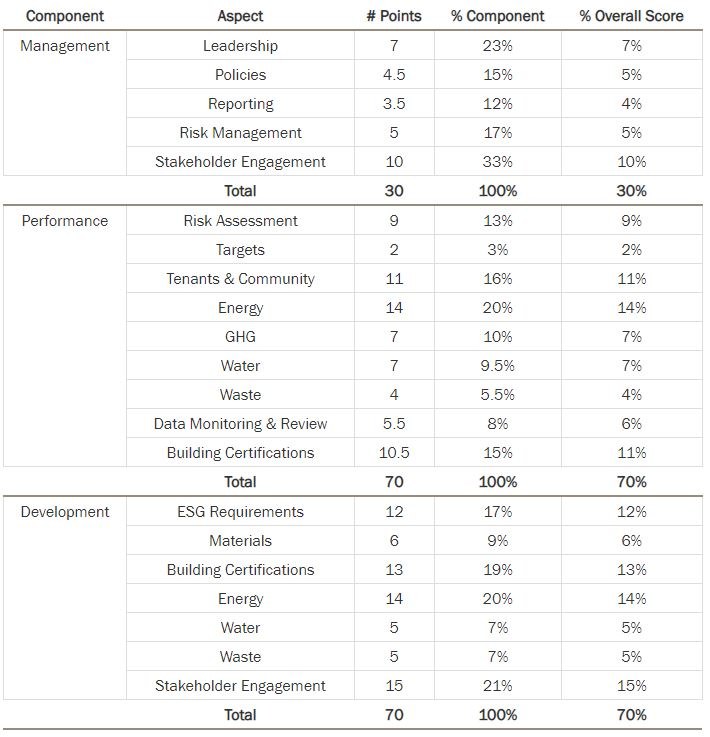

The methodology combines a questionnaire with an automated scoring model, which forms a score in three broad categories: management, performance and development, driven by many ESG-specific issues such as energy usage, waste output and more.

Source: 2022 GRESB Reference Guide

Morningstar

Morningstar has incorporated ESG ratings for stocks and funds but is still expanding in to commercial real estate loan and transaction ratings. Currently, Morningstar has 4 broad ESG groups, with only a handful that directly apply to CRE.

While some have readily available data for example resource and energy management, it’s challenging to quantify some of the more granular items and measure on an individual property level for quantitative measurements for things such as climate and weather risks.

ESG Factors and Decision Making

ESG reporting, though still evolving, is a tangible extension of a company’s brand, the effects of which can make a marked difference in long-term revenues. In PWC’s Emerging Trends report, one commercial building owner stated:

“[ESG] affects your cost of capital, it affects your business plan, it affects the leasability, it affects the type of tenants and by definition, the credit of those tenants. So, it is very much in how we think about even entering a business plan, executing the business plan, cost of capital of exit, and what we’re willing to hold long term in the office market.”

With this in mind, investors, developers, and lenders globally must recognize that ESG performance will increasingly become a factor in investment returns, asset preservation, future leasing potential, and even marketing efforts.

How Commercial Real Estate Lenders Can Utilize ESG Frameworks

Understanding the staying power of ESG standards is the first step for lenders. But how can lenders implement a scalable ESG framework into their investment and management processes?

To begin, commit to integrating ESG into your organisation with a comprehensive policy. Stating your commitment without substantive activities or policies serves little purpose, and puts your organisation at risk of greenwashing, which is specifically scrutinised by the Australian Securities & Investments Commission (ASIC).

Start With ESG Mandates or Global Schemes

Building a precise ESG policy for your firm ahead of time will not only keep your organisation compliant, but it will also put you ahead of many firms who are still in the ideation stage of their own policies.

Instead of reinventing the wheel, follow existing ESG frameworks that are specific to your organisation, industry, and, where required, government mandated. Modeling your company’s policy after the aforementioned frameworks like GRESB, Morningstar, and following proper climate-related financial disclosures can be a great place to start.

Manage, Don’t Just Eliminate

Excluding harmful practices can help your organisation’s ESG efforts, but exclusionary practices risk being supplemental at best. Your organisation can offer a tremendous value to stakeholders by positing your own mitigation strategies, with tangible or measurable results.

For example, is your organisation showing improvements in environmental mitigation like emissions reduction? Are you successfully delivering affordable housing?

Showing the results of your policies provides a strong value proposition and ESG framework implementation.

Contact our team to get the conversation started on your ESG needs, underwriting, loan book management, and much more.

Rebecca Percossi is Executive Managing Director of Trimont’s APAC office.

About Trimont LLC

Trimont (www.trimont.com) is a specialized global commercial real estate loan services provider and partner for lenders seeking the infrastructure and capabilities needed to help them scale their business and make informed, effective decisions related to the deployment, management and administration of commercial real estate secured credit.

Data-driven, collaborative, and focused on commercial real estate, Trimont brings a distinctive mix of intelligent loan analysis, responsive communications, and unmatched administrative capabilities to partners seeking cost-effective solutions at scale.

Founded in 1988 and headquartered in Atlanta, Trimont’s team of 400+ employees serves a global client base from offices in Atlanta, Dallas, Kansas City, London, New York and Sydney. The firm currently has USD 236B in loans under management and serves clients with assets in 72 countries.