Trimont’s European CRE Circulate

Trimont’s experts break down the latest CRE trends from the inside out.

General:

• Activity levels have picked up in Q4 although the majority of transactions are in support of refinances as opposed to new acquisitions;

• In the immediate period following the initial lockdown, many lenders and borrowers agreed to re-allocate existing reserves as part of initial restructurings. Some of these reserves are now being depleted, and we anticipate many will be fully diminished by Q1-21;

• Covenant moratoriums agreed at the outset of lockdown will be expiring during the next two quarters and lenders/borrowers will need to agree on a consensual way forward for the next 9-12 months. Borrowers are already being asked to prepare updated business plans, including in some cases assuming different forecasts/alternative scenarios for 2021;

• Following the approval of New Look’s recent CVA (one of 13 retail/F&B brands to launch CVAs during Q3 alone), and the extension of the government moratorium on tenant evictions for non-payment of rent, we expect the movement to turnover leases in the retail sector will increase during coming months; and

• LIBOR versus SONIA – we consistently receive feedback that the pricing differential between SONIA caps and LIBOR caps continues to frustrate the widespread use of SONIA as a benchmark rate.

Development Loans:

• Work continues on most development sites, albeit often with adjusted programmes to allow for safety measures facilitating social distancing on site. Labour numbers are generally not reported to be of concern, and site access has broadly been maintained (for PM’s, QS’s, etc..) and where not, virtual inspections allow work to progress;

• There are ongoing issues with supply chains for some materials, which is causing delays and, in some cases, inferior materials being delivered. We are seeing an increased incidence of materials being rejected at the site; and

• We have not yet seen claims against contractors for damages due to delays. Most contracts will have mechanisms that typically afford the contractor relief from paying damages for delay and, in some cases, relief in the form of extension of time. Most lenders that we are speaking with are reviewing contracts to determine whether increased costs due to a force majeure event are specifically the responsibility of either party or shared by the contractor and client. Some borrowers have instructed external legal counsel to review their building contracts to understand what reliefs are contained therein.

Investment Loans:

• Borrowers continue to work with tenants to secure longer-term income in exchange for short-term incentives, such as Rent Free periods in exchange for lease extensions;

• The treatment of aggregated arrears and deferred rents will continue to impact debt service cover metrics at the upcoming IPD and future IPD’s. Lenders and Borrowers both need to consider how these two income streams should be treated when preparing cashflow forecasts for covenant testing purposes;

• We anticipate that more borrowers will seek extensions of agreed milestones and standstill periods, as business plans are impacted by ongoing market uncertainty. Some lenders agree to these requests but in return for additional equity commitment from borrowers.

Valuations:

• We are starting to see more Banks calling for updated valuations, having postponed them for the last six months (driven by regulatory and internal credit policies);

• Retail values are still under pressure although target yields have started to stabilise – the ongoing challenge is determining what a stabilised income looks like after deducting over rent, potential CVA’s, permanent voids, and holding costs;

• Stabilised income continue to fall – anecdotally, one regional shopping centre has fallen 10% in value since April owing to a fall in income as opposed to yield movement;

• Well-let, prime offices are holding up, but yields are drifting out for secondary offices with short term income or vacancy risk; and

• We are starting to see the retail funds selling assets – no distress yet highly motivated sellers.

Debt Service Collection:

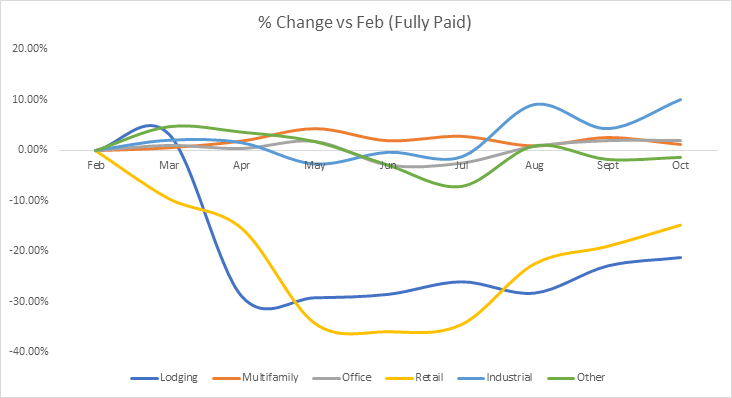

• Trimont has analysed the principal and interest collection rates of its US loan portfolio by comparing February’s collection rate with each month thereafter. The results shown on the graph below highlight the well-documented distress currently being experienced in the Hospitality and Retail sectors;

• In the immediate aftermath of Covid, there was a steep decline (c. 30-35%) of loan facilities in the distressed sectors that were not paid current within the grace period. Whilst there has been a slight improvement in the last couple of months, there has been a decline of c.20% and c.25% of retail and hospitality loans respectively in the number of loans that have fully satisfied P&I obligations when compared with February payments; and

• Whilst this is based on US data, it is fair to assume a high degree of correlation to what we see in Europe.

About Trimont LLC

Trimont (www.trimont.com) is a specialized global commercial real estate loan services provider and partner for lenders seeking the infrastructure and capabilities needed to help them scale their business and make informed, effective decisions related to the deployment, management and administration of commercial real estate secured credit.

Data-driven, collaborative, and focused entirely on commercial real estate, Trimont brings a distinctive mix of intelligent loan analysis, responsive communications, and unmatched administrative capabilities to partners seeking cost-effective solutions at scale.

Founded in 1988 and headquartered in Atlanta, Trimont’s team of 400+ employees serve a global client base from offices in Atlanta, Dallas, Kansas City, London, New York and Sydney. The firm currently has $236B in loans under management and serves clients with assets in 72 countries.